Tapping into Indonesia’s Special Economic Zones Advantage

Indonesia has steadily positioned itself as one of Southeast Asia’s most compelling destinations for global investors. At the center of this transformation is Indonesia’s Special Economic Zones (SEZs). This system is designed to attract capital and build manufacturing strength, export capacity, and regional competitiveness.

For multinational companies, foreign entrepreneurs, and global investors looking toward Asia, understanding how SEZs work is no longer a nice-to-have. It’s quickly becoming a competitive necessity.

Indonesia’s Special Economic Zones Strategy for Economic Growth

The vision for Special Economic Zones in Indonesia took shape in 2014 as a national economic strategy. With operational rollout beginning in 2015, the ecosystem accelerated quickly.

This is not an isolated initiative. It is a long-term strategy to position Indonesia among global manufacturing and services leaders. The government aims to attract over USD 50 billion in foreign investment over the next decade. The focus is on export-oriented manufacturing in Indonesia’s Special Economic Zones.

And the trajectory is promising. By the first nine months of 2024 alone, SEZ investment hit Rp68.43 trillion. It’s above expectations and a clear signal of rising investor confidence.

By now, Indonesia has 25 SEZs spread across the archipelago — many deliberately located beyond Java to reduce inequality and stimulate new regional growth centers.

The results are already substantial. As of mid-2025, Indonesia’s SEZs have attracted over Rp294 trillion (USD17.6 billion), created 187,000+ jobs, and host 442 companies.

Baca juga: Panduan Format Absen Pengawas Proyek Konstruksi

Fiscal Incentives: The Competitive Edge

A major reason Indonesia’s SEZs stand out is their strong tax incentive structure, designed to maximize return on investment. It is arguably one of the most comprehensive in the Southeast Asia region.

Corporate Income Tax Benefits

CIT facilities come in two forms: tax holidays and tax allowances, each calibrated to industry type and investment value. Large-scale investors in primary industries — such as energy, mineral processing, and advanced manufacturing — with more than Rp 1 trillion invested can enjoy 20–100% tax reductions for 10–25 years.

Mid-range investments between Rp500 billion and Rp1 trillion receive 5–15 years of similar benefits. Meanwhile, non-primary industries get up to 30% tax allowance over six years, with accelerated depreciation and 10-year loss carry-forward.

Value-Added Tax Exemptions

VAT exemptions extend across imported goods entering SEZs, inter-zone transfers, and transactions between companies inside the same zone. These exemptions reduce major cost barriers for manufacturers and logistics-heavy businesses.

Import and Excise Duty Exemptions

The import facility streamlines supply chains by covering capital goods, raw materials, and key inputs for all SEZs. This framework means companies can import machinery, components, and raw materials without navigating tariff complications, streamlining supply chain efficiency.

Customs Frameworks

The customs regime treats Indonesia’s Special Economic Zones as fully controlled areas with zero customs duty, generating significant operational cost savings. Goods processed within SEZs and sold domestically qualify for zero customs duty if they meet at least 40% local content. This policy provides a strategic gateway to Indonesia’s 270-million-strong consumer market.

Baca juga: Rekomendasi 5 Aplikasi Kontraktor Terbaik di Indonesia

Non-Fiscal Advantages: Infrastructure and Streamlined Operations

Tax incentives attract investors, but Indonesia’s SEZs operational benefits keep them there. These zones offer streamlined processes that reduce administrative friction and give businesses far more operational freedom.

100% Foreign Ownership

Companies can establish 100% foreign ownership, avoiding partnership requirements common in other Indonesian sectors. This ownership structure provides full operational control and unencumbered profit repatriation.

One-Stop Service Administration

Permitting is consolidated through a one-stop service covering building permits, environmental approvals, and operational licenses. This reduces bureaucratic engagement and saves weeks of administrative processing that would normally require dealing with multiple agencies.

Streamlined Immigration Provisions

Indonesia has introduced on-site immigration service units inside several Special Economic Zones. These allow investors and foreign workers to process residency and immigration documents without leaving the zone. The system streamlines applications for visit visas, ITAS/ITAP, investor-focused permits such as the Golden Visa, and long-stay options for property owners. The goal is faster processing and a more efficient investment environment.

Land Procurement Advantages

Land procurement is also simplified. Investors gain long tenure of land-use rights through HGB of up to 80 years, compared to the usual 30. For capital-heavy operations, this significantly reduces long-term uncertainty.

Online Single Submission (OSS)

The digitalization of licensing through the OSS system further transforms the experience. Under Government Regulation 28 of 2025, companies can now secure a single NIB that functions as their business license, import identification, customs registration, and health/social security enrollment. Processes that once took weeks now finish in hours, allowing investors to move from approval to operation with minimal delay.

Baca juga: Automasi Bisnis, Ini 5 Tools AI Andalan Business Owner 2025

High-Growth Sectors in Indonesia’s Special Economic Zones

The most dynamic investment opportunities in Indonesia’s SEZs are concentrated in sectors aligned with global demand and national industrial priorities.

Manufacturing and Export Processing

East Java’s Gresik SEZ has rapidly become a manufacturing powerhouse, drawing Rp100.85 trillion in investment and employing 41,000 workers by mid-2025. The landmark development is PT Freeport Indonesia’s world-class copper smelter — the largest single-line smelter in the world. With export potential reaching USD 4 billion annually and import savings of USD 2.3 billion, Gresik has become a magnet for minerals processing, metallurgy, and advanced manufacturing.

Central Java’s Kendal SEZ focuses on garments, automotive, electronics, and food processing. With Rp90.12 trillion in investments and 66,000 employees, Kendal is now woven into global EV supply chains. The zone produces lithium battery components exported to the U.S. and supplied to major players like Tesla.

Digital and Innovation Hubs

The Nongsa Digital Park in Batam and emerging zones like Banten International Education, Technology and Health (BITEZ) form Indonesia’s tech innovation corridor. They provide purpose-built facilities for software development, fintech, digital services, and R&D — leveraging Indonesia’s skilled talent pool and competitive cost base.

Tourism and Healthcare

Zones like Mandalika and the Batam International Health Tourism Special Zone align with Indonesia’s push to grow high-value services. Mandalika enhances eco-tourism and agro-industry potential, while Batam’s healthcare hub — anchored by Apollo Hospitals — targets medical tourism and premium healthcare delivery.

Education

The Singhasari SEZ in Malang, East Java — originally designated for tourism — has strategically pivoted toward educational excellence, establishing itself as Indonesia’s flagship zone for knowledge economy acceleration.

The zone achieved international prominence through a landmark partnership. King’s College London formally launched its Indonesian campus within Singhasari in May 2024, marking the first UK-based university establishing direct operations in an Indonesian SEZ.

Energy and Petrochemical Development

Arun Lhokseumawe SEZ, established by Government Regulation No. 5 of 2017 anchors Indonesia’s oil, gas and petrochemical activities. Its location on the Strait of Malaka, serving 500+ million ASEAN consumers, gives it exceptional export leverage. With operators including Pertamina, Pupuk Iskandar Muda, and Pelindo I, the SEZ targets USD 3.8 billion investment and 40,000 workers by 2027.

Galang Batang SEZ, designated under Government Regulation No. 42 of 2017, integrates mineral processing with dedicated energy supply. Managed by PT Bintan Alumina Indonesia, the zone powers its alumina and aluminum operations through 150 MW of PLTU capacity supported by coal gasification. It targets Rp 36.25 trillion in total investment and 23,200 workers by 2027.

Sei Mangkei SEZ integrates palm oil and rubber processing with secure energy supply via a 75 MMSCFD gas pipeline from Arun LNG and a 2×800 MW PLTGU. This ensures reliable feedstock and power for globally oriented oleochemical production.

Tanjung Api-Api SEZ, established under Government Regulation No. 36 of 2016, is rapidly emerging as a downstream energy center. Investments include more than Rp 100 trillion for refinery and petrochemical infrastructure, USD 11–12 billion for LNG regasification, and advanced refinery technologies. These commitments position the zone as a future petrochemical hub for Asian and global markets.

Nationally, Indonesia is embedding renewable energy across energy-focused Special Economic Zones through REBID and REBED. This aligns with the RUPTL 2025–2034 mandate requiring 76% of new generation capacity to come from renewables. Investment in 2026 is projected at Rp402.4 trillion (USD 25 billion), enabling solar, geothermal, hydro, and bioenergy integration in SEZs.

Baca juga: Hadirr vs Kompetitor: Mana Software Absensi Terbaik di 2025

Workforce Excellence: Abundant Talent, Supported by Policy

Beyond cost advantages, Indonesia’s labor strength lies in scale, capability, and ongoing talent development. A nation of 270 million offers one of the world’s largest labor pools, increasingly supported by technical education and industry-aligned training.

The Foreign Worker Utilization Plan (RPTKA) allows SEZ companies to hire experts with five-year work permits, extendable as needed. This enables blending global expertise with local workforce development, aligning with government and investor goals.

Regulatory Modernization: Lower Risk, More Predictability

Investors care about clarity and stability. Government Regulation 28 of 2025 addresses exactly that — expanding licensing coverage from 16 to 22 sectors, adding phased approvals, and introducing deemed approvals to ensure processes don’t stall.

Environmental rules are now clearer and more technical, covering waste management, emissions, and hazardous materials controls. Crucially, companies inside SEZs benefit from zone-level environmental approvals, avoiding repeated project-by-project assessments.

Supporting activities such as distribution, warehousing, and logistics are now formally recognized, allowing businesses to plan their entire value chain with predictability.

Baca juga: Panduan Cara Menghitung Labor Cost yang Tepat & Efisien

Geographic Advantage: Strategic Locations

Indonesia’s geography — in the middle of global shipping routes — already offers logistical upside. The placement of Indonesia’s Special Economic Zones multiplies that advantage.

Java-based zones like Gresik and Kendal plug into Indonesia’s most established infrastructure and consumer market. Java is ideal for companies targeting domestic expansion alongside export operations.

The Batam zone, just 70 km from Singapore, taps into Southeast Asia’s financial and logistics hub. The zone is a competitive alternative to Singapore’s high-cost operations.

Sumatra zones, including Sei Mangkei, are emerging as national leaders in petrochemicals, mining, and downstream processing.

Meanwhile, Eastern Indonesia zones like Morotai, Bitung, Weda Bay, and Sorong provide investors access to key energy and mineral resources. Emerging infrastructure now supports value-added processing of raw materials before export. Weda Bay alone has attracted USD 16 billion in investment. It now generates USD 8 billion in annual exports — an efficiency unmatched by national averages.

Baca juga: Cara Aplikasi Hadirr Optimasi Jadwal Kerja Karyawan

Why Indonesia’s SEZs Deserve Serious Consideration

Across Southeast Asia, investors face trade-offs. Vietnam offers competitive manufacturing costs but presents challenges in land use. Thailand has automotive strength but limitations outside its capital. Malaysia and Singapore provide regulatory ease but at cost profiles that reduce profitability.

Indonesia’s Special Economic Zones framework shifts the equation. With unmatched tax incentives, non-fiscal benefits, modernized regulation, logistics-ready infrastructure, and access to one of the world’s largest workforces, SEZs create a compelling market entry and expansion platform.

Most importantly, the government’s consistent expansion and refinement of the SEZ ecosystem shows long-term commitment. This is not a temporary boost — it is a structural strategy.

For companies in manufacturing, exports, digital services, healthcare, tourism, or advanced technology, Indonesia’s SEZs represent one of the region’s strongest “next frontier” opportunities.

Baca juga: 5 Aplikasi Absensi Online Gratis untuk Karyawan Lapangan

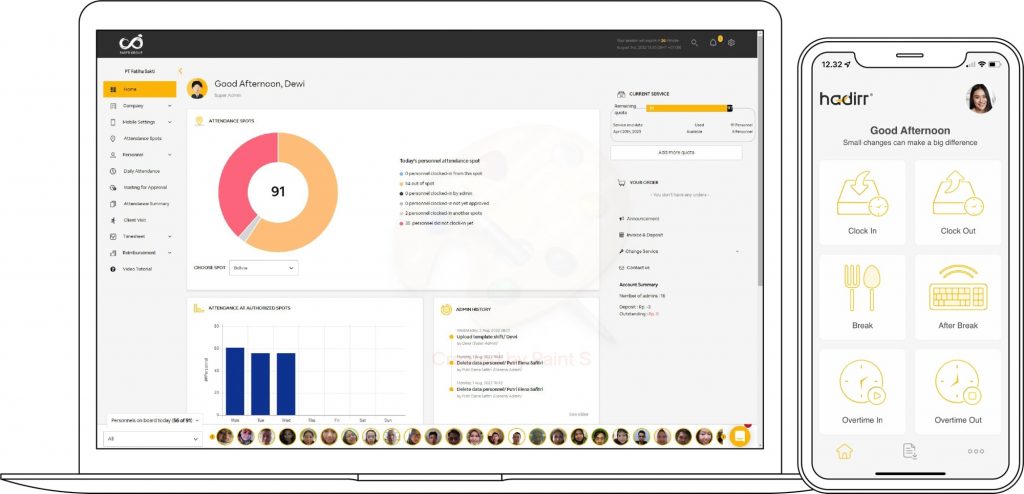

Take Control of Your SEZ Operations with Hadirr

Scaling operations in Indonesia’s Special Economic Zones demands tight coordination. This includes managing teams, tracking attendance, monitoring sales pipeline, processing overtime, and ensuring compliance. As companies grow from single-location pilots into multi-zone and multi-subsidiary operations, these challenges intensify.

Hadirr has become the operational backbone for Indonesian companies navigating these complexities at scale. The platform consolidates multiple functions that would otherwise sit across separate vendors:

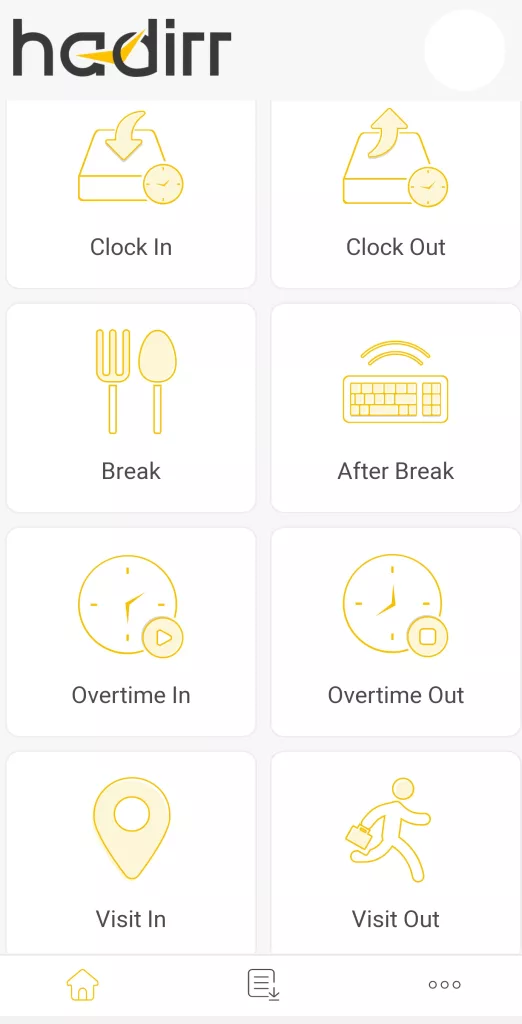

- Digital Attendance & Presence Management

Smartphone-based clock-in and clock-out with GPS geofencing and face recognition delivers precise, tamper-proof attendance documentation. It ensures shift accuracy, overtime control, and eliminates manual or device-based manipulation.

- Sales Pipeline & Client Visit Management

Hadirr mobile CRM enables real-time customer interaction tracking, sales pipeline monitoring, and visit scheduling. It is essential for B2B operations spread across Indonesia’s diverse markets or multiple SEZ locations.

- Shift Scheduling & Overtime Automation

Configure complex 24/7 shift patterns with automated overtime calculations, ensuring payroll accuracy and reducing administrative burden for large manufacturing workforces.

- Operational Integration & Scalability

Seamless integration with Gadjian automates payroll by pulling attendance and timesheet data directly from Hadirr — removing manual transfer, errors, and reconciliation.

As international companies expand within Indonesia’s Special Economic Zones, Hadirr delivers the transparency, automation, and scalability needed to grow without proportional increases in administrative overhead. The tool ensures your operations stay coordinated at every stage. Let Hadirr handle the complexity so your leadership team stays focused on strategy, growth, and competitive differentiation.

Thousands of companies already rely on Hadirr to drive operational excellence across dispersed teams and complex business environments. Start your free trial to explore how our integrated attendance, sales, and operational management platform can support your SEZ expansion strategy.