A Foreign Business Guide to Indonesia’s Product Certification

Indonesia is calling — a market of over 270 million consumers, booming sectors, and untapped opportunities. But before you dream big, know this: the first gate you’ll face isn’t marketing or logistics — it’s compliance. Navigating Indonesia’s product certification and labeling rules isn’t just paperwork. It’s deciding whether your product can even reach shelves, marketplaces, or distributors. Master it, and you unlock the market. Miss it, and your plans stall before they start.

From mandatory SNI standards to BPOM approvals, halal certification, and strict labeling requirements, Indonesia enforces one of the region’s most comprehensive consumer-protection ecosystems. For companies planning market entry in 2025 and beyond, mastering these compliance pathways isn’t optional. It’s the foundation for legal market access, operational continuity, and long-term success.

Understanding Indonesia’s Product Certification Ecosystem

Indonesia’s product certification framework is managed by multiple regulatory authorities, each enforcing its own standards, classifications, and approval mechanisms. The National Standardization Agency (BSN) oversees the SNI certification scheme, while sector-specific bodies govern compliance within their respective domains. BPOM regulates food and drugs, the Ministry of Industry regulates industrial goods, and BPJPH oversees halal regulation.

The key reality is that certification rules vary sharply by product type, risk level, manufacturing process, and intended use. As of 2025, more than 130 SNI certification standards are in effect, particularly for products tied to public safety, health, and environmental protection.

Any missing or incomplete documentation exposes companies to customs rejections, product seizures, heavy administrative fines, and in severe cases, criminal liability. Compliance is not a formality — it is a prerequisite for market entry.

SNI Certification: The Backbone of Product Standards

SNI (Standar Nasional Indonesia) is the core of Indonesia’s national standardization regime, designed by BSN to safeguard product quality, reliability, and safety across industries. Though technically voluntary, a growing list of products requires mandatory SNI certification before manufacturing, importing, distributing, or selling them in Indonesia.

These categories span motor vehicle tires and tubes, electrical cables, household appliances (air conditioners, washing machines, refrigerators, rice cookers), helmets, cement, steel products, LPG cylinders, mineral water, toys, and numerous electronic devices. The Ministry of Industry updates this list frequently — 16 new mandatory SNI regulations were issued in 2024 alone, covering a wide range of industrial goods.

Indonesia’s Product Certification: SNI Schemes

Indonesia employs two primary SNI certification schemes, tailored to different business models:

Type 5 Certification

This is the most rigorous pathway. It requires full factory audits, product testing in accredited laboratories, and yearly surveillance to ensure quality consistency. The manufacturer’s facility and quality management system — typically aligned with ISO 9001 — must be evaluated by Indonesian authorities or accredited auditors. Certificates remain valid for five years, but annual surveillance audits are mandatory throughout the period.

Type 1B Certification

This scheme is designed for shipment or batch-specific imports. Laboratory testing is required for each batch, but factory audits are not. While faster, it is less cost-efficient for regular importers, as every shipment needs its own certification. For occasional or limited batches, however, Type 1B provides a practical, time-efficient route.

Trademark Registration: A Critical Prerequisite

Recent regulatory reforms have raised the bar: trademark registration is now mandatory before obtaining SNI certification. Under Presidential Regulation 28/2021 and subsequent SNI updates through 2024–2025, foreign manufacturers must secure trademark registration with Indonesia’s DGIP before applying for SNI.

This process typically takes 18–24 months, making early planning essential. Foreign applicants must appoint a licensed local IP consultant and submit a power of attorney, trademark samples, and detailed classifications aligned with the Nice Classification system.

Indonesia operates under a first-to-file rule, so unregistered trademarks enjoy minimal protection. Early trademark registration is crucial not only for compliance but also to guard against trademark squatting — a well-known risk in Indonesia’s fast-moving consumer and industrial markets.

Local Representation Requirements

Indonesia’s product certification regulations require SNI applications to be filed and held by a local legal entity — an importer, distributor, or subsidiary. Foreign manufacturers cannot obtain SNI certification directly. They must appoint an Indonesian Authorized Representative to act as the certification holder and importer of record.

Companies must either set up a PT PMA (foreign investment company) or work with a licensed local distributor. A PT PMA requires a minimum capital of IDR 10 billion (with at least 25% paid-up). Incorporation — covering notarial deeds, Ministry of Law approval, tax registration, and OSS licensing — typically takes 4–6 weeks.

BPOM Registration: Indonesia’s Product Certification for Food, Drugs, and Cosmetics

The Indonesian Food and Drug Supervisory Agency (BPOM) enforces some of the strictest product oversight systems in Southeast Asia. Any food, beverage, cosmetic, pharmaceutical, traditional medicine, health supplement, or therapeutic product — whether imported or locally manufactured — must secure BPOM registration before entering distribution channels. This requirement underscores Indonesia’s commitment to public safety, quality assurance, and regulatory integrity.

BPOM Registration Process

Registering a product with BPOM is a multi-stage process focusing on safety and traceability. Timelines typically range from 4–6 months for food products and 6–8 months for cosmetics and pharmaceuticals, depending on risk classification and technical complexity.

The process begins through BPOM’s e-registration portal. Applicants must submit a detailed dossier covering product formulation, manufacturing methods, shelf-life studies, Good Manufacturing Practice (GMP) certificates, and a Certificate of Free Sale from the country of origin.

For imported goods, BPOM requires additional documentation such as authorization letters from the foreign principal, a valid API (Import Identification Number), and laboratory test reports from BPOM-accredited facilities. In some cases, BPOM may audit warehousing or distribution facilities to confirm compliance with storage and handling protocols.

Products from ASEAN member states benefit from reduced registration fees compared to non-ASEAN imports — reflecting regional harmonization initiatives. However, all applicants should anticipate rigorous review cycles. BPOM frequently requests supplementary documents, each potentially adding up to 60 days to the evaluation period.

Mandatory Labeling Requirements

Indonesia’s labeling regulations follow one non-negotiable rule: every consumer product — locally made or imported — must communicate in Bahasa Indonesia. Labels must be permanently attached to the product or packaging using printing, embossing, or integrated design. Temporary stickers are largely prohibited, except for narrow exemptions outlined by the Ministry of Trade.

Mandatory label elements include:

- Product name

- Usage instructions

- Manufacturer or importer details

- Country of origin

- Production and expiration dates (where applicable)

- Net weight or volume

- Ingredient list

- Safety warnings

- Required certification numbers:

- BPOM registration

- SNI certification

- Halal label

Some sectors face stricter rules. Processed foods must display nutritional information — sugar, salt, and fat content — under Government Regulation 28/2024. Cosmetics must carry ingredient-specific warnings, especially for substances like alpha hydroxy acids and hydrogen peroxide. Pharmaceuticals take it further: by December 2025, all products must include 2D Data Matrix barcodes for full supply-chain traceability.

Halal Label: The Essential Indonesia’s Product Certification in Muslim Majority Market

Indonesia’s Halal Product Assurance Law (Law 33/2014) mandates that any product entering, circulating, or sold in Indonesia must secure halal certification. Enforced by BPJPH under the Ministry of Religious Affairs, the law covers food, beverages, cosmetics, pharmaceuticals, and everyday consumer goods.

For imported goods, foreign manufacturers must obtain halal approval from overseas certification bodies recognized under BPJPH’s Mutual Recognition Agreements (MRA). Sixty-eight foreign halal certification institutions are in the approval pipeline, with several — including agencies from Korea and the United States through the American Halal Foundation — already accredited.

Products with valid halal certificates from BPJPH-recognized foreign bodies are exempt from re-certification in Indonesia. However, registration with BPJPH remains mandatory before distribution. The process runs through the SIHALAL online platform and requires end-to-end supply-chain documentation, from raw materials to final packaging, alongside a Halal Product Assurance System (HPAS) across production, storage, and distribution.

Compliance tightened further with BPJPH Circular Letter 7/2025, issued in August 2025, mandating the display of the official Indonesian Halal Label according to BPJPH standards. Companies must also communicate halal status across digital touchpoints — websites, social media, online marketplaces, and digital catalogs. Non-compliance can trigger warnings, fines, temporary suspension, or permanent revocation of halal certificates.

Penalties for Non-Compliance with Indonesia’s Product Certification

Indonesia enforces strict sanctions for Indonesia’s product certification violations, including administrative, civil, and criminal penalties. SNI violations can result in fines up to IDR 5 billion (~USD 320,000) and potential loss of business licenses. Non-compliant goods may be seized, barred from circulation, or destroyed.

BPOM violations carry similar severity. Companies distributing unregistered food, cosmetics, or pharmaceuticals can face forced product withdrawals, facility shutdowns, and fines calculated as a percentage of gross sales. In 2025, BPOM revoked permits for four cosmetic products falsely marketed for oral consumption, ordering immediate market removal, stock destruction, and e-commerce takedowns.

Indonesian competition law adds another layer. Penalties start at IDR 1 billion (~USD 69,500) and can escalate to 50% of net income or 10% of total sales. Repeat offenders or ringleaders face higher fines.

Strategic Recommendations

For foreign companies, preparing for Indonesia’s market is a marathon, not a sprint. Compliance planning should start 18–24 months before launch to account for trademark registrations, SNI certification, and BPOM approvals — each with timelines that can stretch unpredictably. Engaging local legal advisors, certified consultants, and authorized representatives early ensures documents are accurate and government submissions move smoothly.

A precise product classification review is critical. Aligning SKUs with Indonesia’s Positive Investment List and the Lartas restricted-goods catalog clarifies sector-specific requirements, foreign ownership limits, and licensing steps. Products subject to facility audits benefit from pre-assessment of internal quality management systems, closing gaps before official SNI certification inspections.

Financial planning must reflect the layered realities of market entry. Trademark filing fees, mandatory SNI application charges and audit fees, BPOM registration costs, laboratory testing, annual surveillance audits, and ongoing legal representation are all part of the equation. Treat these expenses not as a cost burden but as an investment in credible, compliant operations.

Indonesia’s product certification and labeling ecosystem is designed to protect consumers, elevate product quality, and strengthen domestic industries. Certification should be approached strategically, not as a bureaucratic obstacle. Begin with thorough product classification, secure reliable local partners, and build realistic lead times for documentation, audits, and surveillance.

When paired with efficient operational tools like Hadirr’s smartphone-based attendance, mobile CRM, and productivity tracking systems, regulatory complexity transforms into competitive advantage — helping foreign companies build trustworthy, market-ready brands that resonate with 270 million consumers.

Managing Sales Operations Efficiently with Hadirr

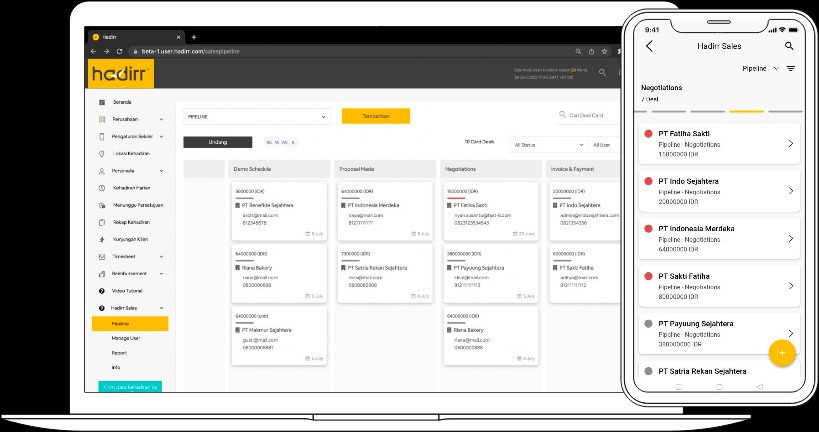

Once products are certified and ready for market, operational efficiency becomes critical. Hadirr Sales offers tools specifically designed for managing field sales forces, driving revenue, and scaling certified product distribution across Indonesia’s diverse geography.

Build a Stronger Sales Process

Certified products demand structured go-to-market execution. Hadirr Sales provides end-to-end sales pipeline management — from lead capture through deal closure. Track customer data, document sales activities, and monitor every stage of your mobile CRM workflow to ensure consistent revenue growth and predictable sales forecasting.

Boost Team Productivity and Market Reach

Your smartphone-based attendance system integrates seamlessly with Hadirr Sales, enabling your field team to log time, visit locations, and close deals without returning to the office. This mobile CRM solution gives your sales representatives more time in the field selling certified products while managers maintain real-time visibility into team performance and customer engagement.

Streamline Sales Activities and Performance Tracking

Record client visits in real time with location data, meeting notes, and follow-up actions. Hadirr’s integrated productivity and time tracker ensures every sales interaction is documented — critical for understanding market penetration, customer satisfaction, and deal velocity. Monitor activity levels, identify top performers, and optimize territory management with automated reporting.

Achieve Sales Targets Through Data-Driven Insights

Transform raw activity data into actionable intelligence. Hadirr Sales delivers automated sales pipeline analytics — showing which deals are moving forward, where deals stall, and which customer segments drive the highest margins. Use these insights to refine sales strategies and accelerate product adoption across Indonesia’s market.

Affordable, Scalable Sales Infrastructure

Hadirr Sales removes the barrier to enterprise-grade mobile CRM technology. Start with core users and scale as your distribution network grows. Flexible pricing means you pay for what you need — no expensive enterprise contracts that drain cash flow during market launch phases.

Breaking into Indonesia isn’t just about meeting regulations — it’s about building trust, credibility, and a market-ready brand. With strategic planning, reliable local partners, and tools like Hadirr Sales, regulatory hurdles become stepping stones to growth.

Get certified. Sell smart. Grow efficiently. The 270 million-strong Indonesian market is waiting — the question is, are you ready to meet it head-on?

Transform your certified products into market success with Hadirr Sales. Try Hadirr for free today.